Recently there seems to be a mini-trend of founders opting to raise smaller amounts of capital to minimize dilution.

Many of these companies go through YC or other accelerators, which take around 7% equity before any financing. An additional ~20% dilution on top of this would certainly seem excessive, especially at such an early stage of the company.

While it’s hard to generalize, I personally wouldn’t advise this for a few reasons:

- All things being equal, it’s reasonable to think that a VC would care more about a company in which they own a meaningful percentage of shares compared to a company in which they don’t

- Usually, the logic goes like this: Raise a little now, and with a bigger metric (and a better market), raise big capital later on. But what if the bigger metric doesn’t come? Then you’ll run out of cash with no metric to show for it, leaving you with few options other than something like bridge funding at unfavorable terms

- Founders’ net worth is calculated as ownership shares multiplied by market value, but since market value is such an outsized factor, it’s practically the only one that matters. For instance, Jensen Huang owns 3.x% of Nvidia, and Reed Hastings owns 1.x% of Netflix, but obviously both are multi-billionaires. Therefore, if raising more money now can significantly increase the enterprise value, founders should consider this option even if means greater dilution.

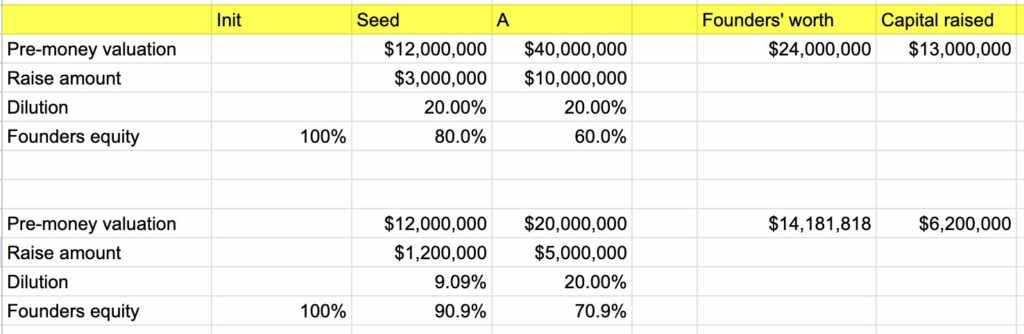

In a quick example below, you can see two different cases. In the top case, the founder raised more capital ($3M) with a typical dilution of 20%, while the founder in the bottom case didn’t want to dilute too much and only raised $1.2M. If raising more capital led to bigger metrics (and a higher valuation accordingly), by the next raise, if both companies raise with similar dilution (20%), company A’s founders would have a higher net worth than company B’s founders, AND the company would have raised more capital. Of course this is a simple, back of the envelope calculation, and in real life cases there are so many other factors in play, but you get the point.